Guest post by: Umer Ishfaq

AS every frugal and cautious individual, you may have got plans. Things you want to do and buy as well. There must be some milestones you look forward to achieving.

There are urgent financial duties like paying for bills groceries and monthly rent or mortgage at one hand and at the other is retirement, which may be years, or even decades, away.

In all of this labyrinth, there are also our desires and necessities like a home, car, small business website design, exotic vacations & cuisine, health expenses, and education costs.

When you have a limited amount of capital, as most people do, reaching your financial goals takes a lot of strategic planning. Here’s a guide on to properly setting financial goals:

If you knew how to make $1200 a month online, from the comfort of your home, would you do the work?

It’s FREE to get started, too (no credit card required). You’ll like that part…

Financial Goals and Strategy: Where to Begin?

First, let’s start with a financial goal planner.

Financial Goal Planner:

Goal 1. Save up $500 to suffice for the contingencies

The best criterion for contingency reserves is to save up enough money to cover a few months’ subsistence costs so that a setback or an affliction won’t drive you in a deep debt hole.

The best criterion for contingency reserves is to save up enough money to cover a few months’ subsistence costs so that a setback or an affliction won’t drive you in a deep debt hole.

But for many people, accumulating these additional expenses in saving is too tricky. So put aside the grand goal and focus on short term goal of saving $500, which would at least help with an unanticipated repair at home or a medical bill.

Goal 2. Add to your 401(k)

If you have an employer-sponsored retirement program, such as a 401(k) or 403(b) (the version for charity and public service workers) and your organization meets any part of your aiding, waste no time and sign up immediately. Give at least enough money to receive all the parallel stocks your organization gives.

The most common employer match is half of the benefactions, up to a fraction of monthly salary. That could be interpreted as easy money worth a tiny fraction of your salary every year. It’s all about squeezing the easy money that an employer match gives you.

Goal 3. Repay any debt

If you carry debt on you through credit card and repay at a high-interest rate, you’ll have more in interest by paying down than you accomplish to earn through funding.

If you carry debt on you through credit card and repay at a high-interest rate, you’ll have more in interest by paying down than you accomplish to earn through funding.

How To Prioritize Multiple Financial Goals?

Once you’ve got those first financial goal requisites, it’s time to start planning for them.

Once you’ve got those first financial goal requisites, it’s time to start planning for them.

Retirement is one of the many financial goals that almost everyone has during their adult life. Choosing how much of every salary to focus on a savings goal, the near-term and the long-term ones is a critical activity that needs maintaining a perfect balance.

But it’s certainly achievable.

We’re staunch believers in the “treat yourself first” school of thought by directing a portion of your salary into your Future Self’s saving bank right off the bat.

Protecting 10% of your pretax earnings is a good place to start; 15% is golden. If you’re adding to your 401(k), you’re on your way. Why? Because since both your participation and your employer’s benefaction calculate toward that 10% or 15% of the end.

Then, as the retirement thrifts machinery runs on autopilot in the backdrop, you can concentrate on your more urgent cravings and requirements (such as kitchen, car and wardrobe upgrades and additions). As for those non-retirement financial goals, ask yourself:

1. How much will it take? Feasible saving goals begin with realistic value approximations. Research the original value of everything on your buying list to guarantee your goal is in the ballpark of actuality.

2. How early do I want the money? Distribute that expense by the number of months, weeks, or years between now and your deadline. If that number causes you to do a double-take, think of fixing the goal (replacing a less expensive option) or the time span (shifting the dream family sabbatical out until next year).

3. Where should I put my savings? The solution here relies on the sort of period you disembarked on, a response to the last question.

If you think to approach your goal in the limited time of five years or less, you should think of short-term investments like these:

| Investment | Quick facts | Implied Yield |

| Online gains or money market account |

|

1% – 1.5% |

| CD |

|

1% to 2%

(longer term = higher rates) |

| Short-term bond funds (index or ETF) |

|

1% to 3% |

You might wonder why stocks aren’t on that table. Although the stock market has compensated long-term investors with plentiful profits, over a slight duration of time, it is likely to swing wildly.

For example, say you’d financed $100 in 2008, right before the Great Recession started. Your balance would’ve fallen to just $43 at the base. Now imagine how you’d respond if that $100-turned-$43 had been reserved for the next summer’s respite or your kid’s freshman-year tuition, due that fall.

Conclusion:

The cash you require within the subsequent five years should not be advanced in the stock market.

Contrary to that, the money you don’t require to encounter for the following decade, or three, or four, is a front-runner for stock investment.

Why? Because you have more liberty to wait out the market’s saturation and ride the ultimate restoration. (Remember that $100? Left advanced, it would’ve recoiled back from the recession and expanded to more than $180 by September 2018.)

For most people, this kind of long-term time limit relates to retirement earnings. And for that precise goal, there are specially devised accounts with the tax-favored approach from the IRS.

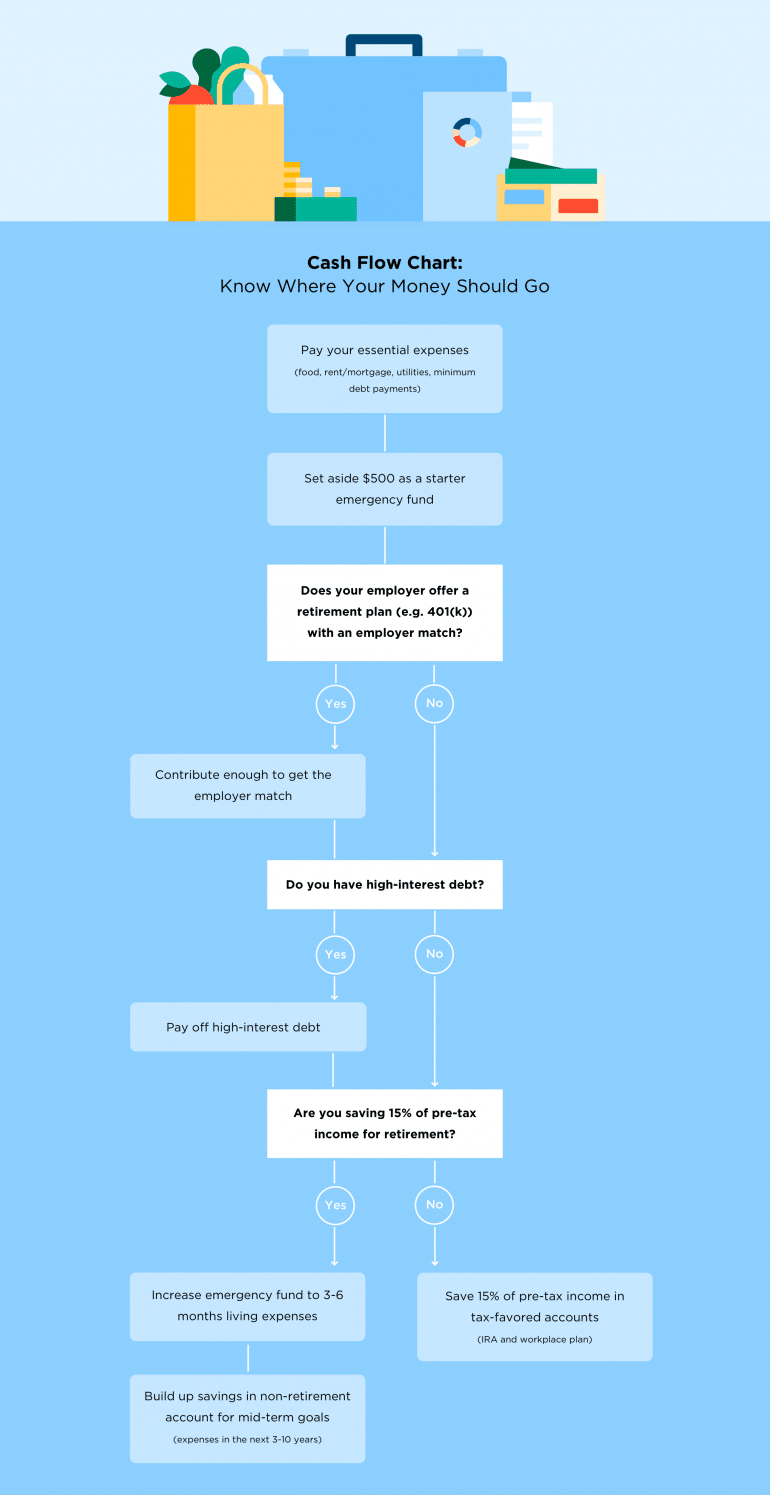

What to do when there’s only so much paycheck to go about? I made this helpful infographic to explain how you can manage your dollars when you’ve acquired various financial goals and opposing preferences:

Take a screenshot. Print it out and paste it where you can see it every day. Doodle daily attestations in the borders (“Bali, here we come!” “Debt, your days are numbered…”) and use it as a source whenever there’s a question about which financial goal should get your spare change.

Imagine for looking for legit work-from-home opportunities and finding THIS when you go inside… WOW

Yes, the raw, sizzling beauty of passive income stream online… Just click here now (because sometimes ‘later’ becomes ‘never .‘)

About the Author

Umer Ishfaq is a Search Engine and Content Advertising expert at Website Klub. A writer by day and reader by evening, his passion for supporting people in all aspects of online marketing runs through in the expert industry coverage he provides.

ARE YOU looking for ways to create a legit passive income online?

ARE YOU looking for ways to create a legit passive income online?